Doha Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 24 January 2024.

With thousands of visitors arriving in Qatar every day, one of the frequently asked questions is how much cash can you carry to Qatar? Qatar Customs has defined clear policies on the import of currencies and other monetary instruments.

This article will explain the Qatar Customs Currency Limit as per the official sources. We will also cover the Qatar Customs allowance for gold and other precious jewellery.

Qatar Customs Currency Limit

Qatar Customs has not defined a limit on the amount of currency that can be bought to the country. However passengers are liable to declare any import of currency above a specific limit, as follows:

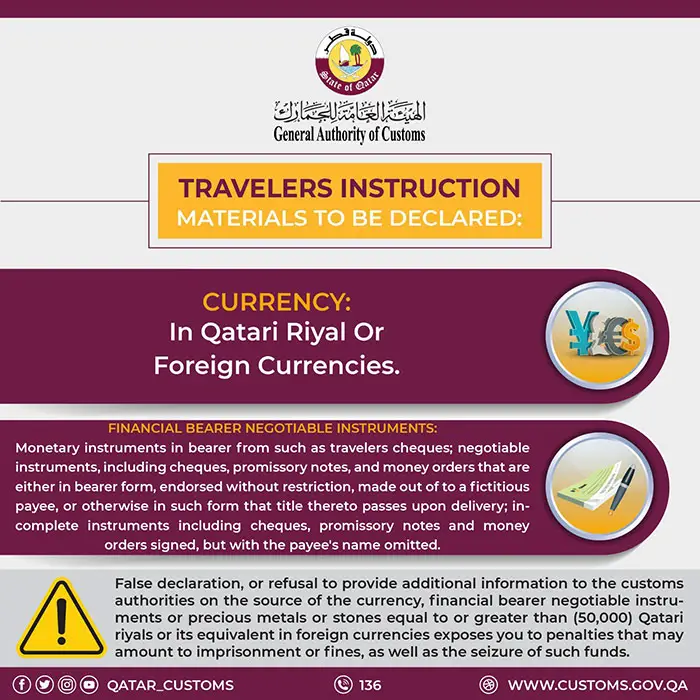

Any person in possession of any currency, bearer negotiable instruments, precious metals or stones equivalent to or higher than QAR 50,000 or its equivalent in foreign currencies must fill out the declaration form and hand it over to the Customs Authority.

This declaration form has to be filled at the designated Customs offices located at all air, sea and land ports of the country.

Not declaring or providing incorrect information may expose you to legal measures.

This is part of the enforcement of Law No. 20 of 2019 on combating money laundering and terrorism financing and Cabinet Decision No. 41 of 2019 on the executive regulations of the same law.

What all items need to be declared?

Travellers are required to declare the following items if they are worth over QR 50,000:

- Currency notes, including Qatari riyals or foreign currency.

- Financial instruments that can be used for transactions such as a document in the name of the bearer. These include traveller’s cheques, bank cheques, signed payment orders and bonds, among others.

- Precious metals such as gold, silver, and platinum.

- Precious stones such as diamond, pearl, emerald, sapphire etc.

Should I declare if I am not asked to?

According to General Authority of Customs (GAC), the traveller has to voluntarily fill up the designated form in case he/she is carrying QR 50,000 or more or its equivalent in the form of the above-mentioned items.

The traveller should also submit any related and additional information required by the GAC officials.

Procedure for Declaration

- Arriving/departing passengers shall declare to customs any currencies, coins, negotiable monetary instruments, precious metals or precious stones exchangeable into cash in their possession.

- Based on risk assessment, the customs officer shall verify the information on the declared currencies, coins, negotiable monetary instruments, precious metals or precious stones.

- After entering them into the automated system and stamping the Declaration Form with the customs seal, he shall give the passenger a copy of the Declaration Form and allow him to enter/exit the country.

- Customs Offices shall communicate the details of the Declaration Form to the competent authority.

Punishment For Non-declaration

Providing false information, not submitting a written declaration in the first place or refusing to supply the necessary details required by the GAC, such as the source of the money, would entail jail sentences of up to three years or fines ranging from QR 100,000 to 500,000 or double the sum of the value of the money in question, whichever is higher. In addition, the money found on the passenger would be seized.

Frequently Asked Questions

How much cash is allowed through Qatar customs?

There is no limit on the cash allowed if you have legal source. However you need to declare any amount above QR 50,000 and prove source of money if asked to.

Do you have to pay duty on cash above the limit?

If the cash has a legal source with proper documentation you don’t have to pay any duty.

How much gold jewellery can I carry through Qatar?

You can carry gold jewellery up to the value of QR 50,000. Any jewellery above this limit should be declared and you may be asked to show supporting documents.

Related Articles:

- Doha Airport Transit Procedure

- MOI Qatar ID Visa Check and Printing

- Qatar Visit Visa Types, Requirements and Procedure

Copyright © DohaGuides.com – Full or partial reproduction of this article in any language is prohibited.

Source: General Authority of Customs

how many grams of Gold jewellery items(Personal use) allowed bring from qatar to the Sri Lanka…..?

When traveling to Qatar, it’s important to be aware of the customs regulations regarding currency and gold allowances.

Currency Limit: There is no specific limit on the amount of currency you can bring into Qatar. However, if you are carrying QAR 50,000 (approximately USD 13,700) or more in cash or equivalent in other currencies, you must declare it upon arrival. This also applies to other monetary instruments, precious metals, and stones of the same value.

Click here goldrate.qa

Hello.

I will be transiting through Doha from Africa to a city in Asia and will not exit the airport. I shall be carrying some gold bars which are worth over the QAR 50,000 threshold for import. However, these gold bars will not be imported but just transit through Doha airport.

Are there any issues in bringing good through security, and are there customs formalities to fulfil (even though we will not pass through customs)?

Thank you for your response.

Kind regards,

Giovanni

Hi sir/mam i want to buy jewellery from Qatar and wanna to bring it to the country Pakistan (4.5 tola) i searched that there is no customs to pay if i would have cleared documents but is there any customs to pay in Pakistan please help me

Hi Moeen, Sorry, we are not sure about that as we see conflicting information on official websites. You can either check with other Pakistani nationals who travelled recently or check with the relevant authorities such as the Federal Board of Revenue (FBR) in Pakistan or contact the customs department directly. They can provide you with the latest regulations and guidelines regarding the import of gold.

I would like to get with me to Qatar, diamond jewellery to introduce our factory for getting orders.

I wont sell the items I’m brining in to Qatar , just to show them and bring them back with me to Dubai?

Is there any fees, duty, tax to be paid since i will enter and leave with the same value and jewellery items.

Pls advice/ thanks

Hi Aldo, Travellers carrying precious stones like diamonds valued above QR 50,000 should declare them upon arrival. It is expected that these are for personal use and not for sale. The customs portal does not say anything about duty or tax to be paid. However, you can double-check this by emailing the Customs authority at [email protected] and the Qatar Government Helpline at [email protected].