Doha Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 02 February 2024.

What is End of Service Gratuity?

According to Qatar Labour Law, End of Service Gratuity is a sum of money stipulated to be paid to an outgoing employee based on the service period. This is calculated based on your employment contract and the number of years you have worked for the company.

This article explains the Labour Law regarding End of Service Gratuity and how you can calculate the end-of-service gratuity using the online tool provided by the Ministry. We have also included a Free Qatar Gratuity Calculator in English.

Qatar Gratuity Calculator in English

Qatar’s Ministry of Labour provides an online service that allows applicants to calculate the end-of-service gratuity on its official website. However, this page is only available in Arabic.

For your convenience, DohaGuides.com has developed a similar online calculator in English. You can check the calculator below:

Note that you must enter data as per the contract signed between you and your employer.

Please note that you are not eligible for End of Service Gratuity if your service is less than one year.

This calculator will give you an approximate amount of your end of service gratuity. The exact amount would be based on your company’s HR policies.

How to Calculate Gratuity in Qatar 2024

For those who are looking for quick info, let’s summarise the law:

- An employee is eligible for gratuity if he has worked for at least one year.

- The minimum gratuity payable is 21 days basic salary per each year.

- The last basic salary shall be the base for gratuity calculation.

- The employer is entitled to deduct from gratuity any amount due to be paid by the worker. [2]

Sample Computation of Gratuity in Qatar

Let’s illustrate this with an example. Suppose your basic monthly salary is 1,500 QR and you have worked for 5.6 years with the same company.

First, calculate your daily basic salary:

Daily basic salary = (monthly basic salary) / 30 (days)

Daily basic salary = 1500 ÷ 30 = 50 QR per day

Now, calculate your gratuity for 5 years:

Gratuity = (number of completed years) x (21 days per year) x (daily basic salary)

Gratuity = 5.6 x 21 x 50 = 5,880 QR

So, in this example, you would be entitled to a gratuity payment of 5,880 QR when you leave the company after completing 5.6 years of service with your 1,500 QR basic salary.

End of Service Gratuity: What the Law Says

The end of service gratuity is calculated under Labour Law No. 14 of 2004.

Upon termination of the employment contract, an employee is entitled to an end-of-service gratuity and leave salary. Under Article 54 of the Labour Law (Law No. 14 of 2004), the employee is eligible for a minimum of three weeks’ basic salary as an end-of-service gratuity for each year.

| Service Period | Gratuity Amount |

|---|---|

| Less than one year | No gratuity |

| One year and more | 21 days basic salary per year |

As per Article 54 of Law No 14/2004:

The Worker’s employment shall be considered continuous if it is terminated in cases other than those stipulated in Article 61 of this Law and is returned back to Work within two months of its termination.

The last Basic Wage shall be taken as the basis of the calculation of the gratuity.

The Employer shall be entitled to deduct from the service gratuity the amount owed to the employer by the Worker.”

Vacation Pay

As per Article 81 of the said law, if the employment contract is terminated for any reason before a worker takes his vacation (annual leave), he shall be entitled to payment instead of annual leave equivalent to his wage for the leave days to which he is entitled [1].

Flight Tickets

When the employment contract is terminated, the employer is responsible for repatriating the employee back to the place from where he was recruited or any other place agreed by the parties. However, if the worker joins another employer before departure from the country, this obligation shifts to the new employer.

Gratuity During Unpaid Leave

If the employee takes unpaid leave, this period is excluded from the service period calculation. As a result of unpaid leave, the period of service is reduced by the number of days served as unpaid leave.

Qatar Labour Law on Gratuity After 5 Years

Many readers ask us if the gratuity is higher if an employee has worked for more than 5 years.

The reason for this question is that there was such a clause in the previous labor law. However, this is not the case anymore.

The clause that stated a worker should be paid four weeks/year for working 5-10 years and five weeks/year for more than ten years was part of the old labor law and is no longer valid.[3]

As per the current law (Law No 14 of 2004), gratuity shall be agreed upon by employer and employee, provided that it is not less than a three-week remuneration for every year of employment.

Qatar Labour Law on Gratuity After 10 Years

As previously explained, the gratuity calculation remains unchanged even if the employee has worked for more than 10 years. It will still be 21 days basic salary per each year.

NOTE: The labour law only states the minimum gratuity. Some companies may choose to pay more than three weeks’ salary to employees based on their length of service. This is up to the management’s decision and HR policies.

Can Employer Terminate Employees Without Gratuity?

According to Article 61 of the Labour Law, there are certain situations under which an employer may dismiss an employee without the payment of the end of service gratuity. Instances of such gross misconduct include:

- If the Worker assumes a false identity, alleges a nationality other than his or submits false certificates or documents.

- If the Worker commits a mistake which causes gross financial loss to the Employer provided that the Employer shall notify the Department of the mistake within twenty-four hours from the time of awareness thereof.

- If the Worker violates more than once the written instructions of the Employer concerning the safety of the Workers and the Establishment despite being notified in writing of the violation on condition that such instructions shall be written and posted up in a conspicuous place.

- If the Worker fails more than once to carry out his essential duties under the Employment Contract or this Law despite being notified in writing thereof.

- If the Worker discloses the secrets of the Establishment where he is employed.

- If the Worker is found during the working hours in a clear state of drunkenness or under the influence of a drug.

- If the Worker assaults the Employer, the manager or one of his supervisors in the workplace during the working day or by reason thereof.

- If the Worker repeats the assault on his colleagues in the workplace despite being warned in writing thereof.

- If the Worker absents himself from Work without legitimate cause for more than seven consecutive days or fifteen interrupted days in one year.

- If the Worker is convicted by a conclusive judgment in a crime of dishonour or dishonesty.

Will Gratuity Be Paid in Case of Worker’s Death?

According to Article 55 of the Labour Law, if the worker dies during the service, regardless of the cause of death, the employer shall deposit with the treasury of the competent court any wage or other entitlements due to the worker in addition to the end of service gratuity within a period not exceeding fifteen (15) days from the date of the death.

The minutes shall contain a detailed report indicating the method of calculating the amounts referred to. The employer shall deposit a copy of the minutes with the Department.

The competent court shall distribute the deposited amounts among the deceased worker’s heirs. This shall be done in accordance with Islamic Sharia provisions or the Personal Status Law applicable in the deceased worker’s home country.

If three years have elapsed since the date of the deposit without the person deserving the due amounts being known, the court shall transfer these amounts to the State Public Treasury.

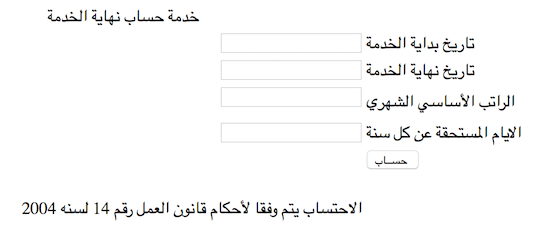

Calculate Gratuity on Ministry Website

You can also calculate the end-of-service gratuity on the Ministry of Labour website. This is done by entering your joining date, last working date, basic monthly salary and the number of gratuity days due each year.

Although the service is available only in Arabic, non-Arabic speakers can also easily calculate ESB by following these steps:

STEP 1: Click on this link to open the calculation page. You will see the following fields in Arabic:

STEP 2: In the first field, enter your Date of Joining (as per your contract).

STEP 3: In the second field, enter your Last Working Date.

STEP 4: In the third field, enter your Basic Monthly Salary (as per your contract).

STEP 5: In the fourth field, enter the Gratuity Days accrued for each year (for example, 21 days for one year). You have to refer to your contract for this.

STEP 6: Click the bottom button to see the result.

This service was introduced to ensure greater transparency and make foreign employees aware of their rights.

Leaving Qatar? Travel in style!

FAQ on End of Service Gratuity in Qatar

How is the end of service gratuity computed?

End of service gratuity is calculated based on the employment contract and the number of years the employee has worked for the company.

How much is the minimum gratuity in Qatar?

According to Law No. 14 of 2004, for each year of employment, the employee is eligible for a minimum of three weeks’ basic salary as the end-of-service gratuity.

How can I calculate the end of service gratuity?

You can calculate end of service gratuity online by going to the end of service gratuity calculator on the Ministry website.

What can I do if my employer refuses to pay end of service gratuity?

If your employer refuses the end of service gratuity without any reason, you can file a complaint at the Ministry of Labour.

I am working with the same company since 1990. Am I entitled to receive gratuity from 1990 or only from 2004?

If the person is working with the same company, he is entitled to gratuity from the date of joining. In this case, he is entitled for gratuity from 1990.

READ NEXT: How Expatriates Can Change Jobs in Qatar

Follow Us On WhatsApp

Related Articles:

- How To Check Qatar Travel Ban (3 Easy Ways)

- How to Change Job in Qatar Without NOC

- Qatar Labour Law on Working Hours and Overtime

- Qatar Labour Law on Sick Leave and Maternity Leave

- Qatar Labour Law on Annual Leave and Holidays

- 11 Easy Ways To File Labour Complaint In Qatar

- Freelance Visa In Qatar: Is It Legal?

Copyright © DohaGuides.com – Unauthorized reproduction of this article in any language is prohibited.

References:

[1] Law No. 14 of 2004 – Article 81

[2] Law No. 14 of 2004 – Article 54

[3] Law No. 14 of 2004 – Article 13 is about repealing Law No. 3 of 1962 – Article 24

Aneesh, the Founder & Editor of DG Pixels, holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.

how much is my gratuity? start 2019 feb 24, end may 20 2021.

what is the “Days due for each year”?

Hi Maykol, If gratuity calculation is not mentioned in your employment contract, days due would be 21 days per year.

hellow po ask kilang po magkano po makukuha ko n graduity ..7years and 5months n po ako s boss koh as a househelper…mothly salary kopo 1700…pa hel0 naman poh..salamat po

Hello Evelyn, Gratuity would be your 21 days basic salary for each year you have worked. Please use the above calculator.

How to calculate end of service gratuity in Qatar I start working dec.2012 I want to end my work on Dec.2021

Hi Daisy, The gratuity is 21 days basic salary for each year you have worked. You can use the above calculator.

I’m starting my job as a household worker feb 14 2021 and i will extend until September and my salary is 1600 Qatari riyal how much my gratuity..tnx

Hi Rosaida, Please note that you are not eligible for End of Service Gratuity if your service is less than one year.

Am in Qatar since 16 March 2018 to 30th may 2021 , kindly calculate my end of service

Basic salary 1000

Hi Rafiq, It would be around QR 2190.

hi gud day a pleasant day to all of us I have a little question can you give me the exact formula or how to calculate my gratuity I am working exactly 3 years in the company my basic salary is 1900 riyal how much money i can get to my employer thank you so much for your favourable attention.

Hi Rey, It is a minimum of 21 days for each year’s basic salary. In your case, it would 1900 * 21/30 * 3 years = 1330 * 3 years = 3990. You can use the above calculator.

Hi,

I wish to change job. But my employer gonna cancel my visa. And changing processes not started yet. Is any possibilities to block the cancellation of my visa. My visa is already experd last month.. And i submitted resignation letter before two month..

Hi,

I’m di ana Campillo

I’m working as a cook

My contract started on 06/01/2019

End of 06/01/2021,

Thanky you.

My boss is asking money from me but i don’t owe him any payment or money. In my contract it is listed that the company needs to provide my ticket back and forth but now my boss is telling me that i need to pay the ticket i used to go here in Qatar. And also I finish 1 year and 3 months in my company but he don’t want to give my gratuity. What should I do? And is this listed in Qatar Labor Law? Thank you so much for your answers.

Hello. I’m household here at Qatar. I work from year September 2016 to march 2021. Only salary is 1400. No increase salary. How sad. But my question is how much my gratuity?

Hi April, As per the law, the gratuity is 3 weeks salary for each year you have worked.

hi, my name is shahidul islam shahin.

i work in qatar sanayya,support center reply to you??? please telling this reply message… ok… thank you👍

It is not fair and reasonable that things can be changed without even consulting the workers how they feel about their salaries and after working for 6 Years the company can not pay 28 – 30 days, workers are only they are eligible for 21 days.

Where did humanity go? While working for the richest country in the world, workers deserve the best as the country deserves the best (win win mutually)

Hi, I have worked 5years 6months. Will the days due will be lessened to 21 days and not 24 days? Is it really not valid anymore that 5-10 years will get 4 weeks and are we included to this new rule not the rule in wich year we signed the contract?

Hi Zabuza, As per the new law it is a minimum of 21 days per year (irrespective of how many years you work). However, if your contract specifically mentions the terms of gratuity, then your contract terms would be applicable (if it is more than 21 days).

i am working from 8 year and 5 month ,so what is the letest labour low my basic salary is 2100.how much i can get form my emplyer.

Hi Laxmi, The minimum gratuity is 21 days’ salary per year.

Hello , what if my employer dont want to pay me gratuity what can i do ?

Hi hello jocelyn I ask about gratuity if will go I will take may employers I’m 7years here now in Qatar.. I don’t want to extend but my employers she till I’m extend but she not pay my ticket also

Hello, I’m working 9 years complete. So I want go finish. How many days early I can get gratuity?

Hi Good Day,

I finished my two years contract last 2019 and i returned same employer and I renewed my contract. Can I still get my gratuity for my past two years contract with my employer?

Thank you.

What is the requirements to process the graduity?

Hi Good Day,

House workers or Khadama still can have gratuity even they increased salary?

Thank you.

Hi Annabelle, Yes, domestic workers are eligible for end of service gratuity according to Law No 15 of 2017.

Hey there!

House staff or kadhama also included the graduity?

Hi Christine, Yes, according to Law No 15 of 2017 domestic workers are entitled to an end-of-service gratuity which will be a minimum of three weeks of wages for each year of service.